Is Buying a Foreclosure a Good Idea?

When it comes to real estate, the word "foreclosure" often piques the interest of investors and homebuyers alike. Foreclosed properties—homes repossessed by lenders due to unpaid mortgages—are usually sold at a discount, making them seem like a golden opportunity. But is buying a foreclosure a good idea for everyone? Let’s dive into the advantages, potential pitfalls, and essential factors to consider before making your move.

Content

The Pros of Buying a Foreclosure

1. Significant Cost Savings

Foreclosed properties are often sold below market value. Lenders are eager to recover their money quickly, so they may list homes at attractive prices, creating opportunities for substantial savings.

2. Investment Potential

For savvy investors, foreclosures can be a goldmine. With the right renovations, these properties can yield high returns, whether you're planning to flip the property or turn it into a rental.

3. Less Competition

Unlike traditional home sales, where bidding wars can drive up prices, foreclosure sales often attract fewer buyers due to the complexity of the process. This can give you a competitive edge.

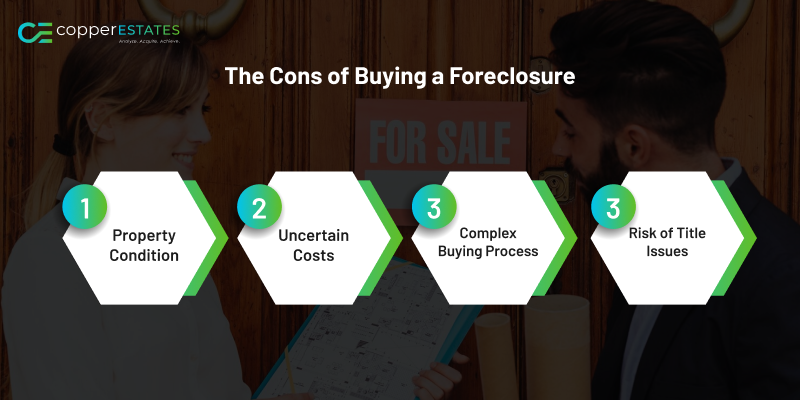

The Cons of Buying a Foreclosure

1. Property Condition

Foreclosed homes are typically sold “as-is,” meaning you inherit any issues the property has—plumbing, roofing, structural damage, or neglected maintenance. You might even face vandalism or theft of fixtures by previous occupants.

2. Uncertain Costs

What you save on the purchase price could be spent on unexpected repairs and renovations. It’s crucial to budget for these potential expenses to avoid surprises.

3. Complex Buying Process

The foreclosure buying process often involves auctions, cash-only deals, or strict timelines. These factors can be intimidating, especially for first-time buyers.

4. Risk of Title Issues

Some foreclosures come with liens or unpaid taxes that you, as the buyer, may need to settle. Conducting a thorough title search is essential to avoid legal complications.

Types of Foreclosure Sales

Understanding the different stages of foreclosure can help you decide where to focus your efforts:

-

Pre-Foreclosure: The homeowner is in default but still owns the property. You may negotiate directly with them for a short sale.

-

Auction: Properties are sold at public auctions to the highest bidder, often requiring cash payments.

-

Bank-Owned (REO): The property didn’t sell at auction and is now owned by the lender. These are often listed on the open market.

Who Should Buy Foreclosures?

Foreclosures can be a great fit for:

-

Seasoned Investors: Those familiar with real estate transactions and property management.

-

DIY Enthusiasts: Buyers comfortable with home improvements and renovations.

-

Cash Buyers: Those who can navigate auction processes requiring full payments upfront.

Key Tips for Buying a Foreclosure

-

Do Your Research: Understand the local real estate market and identify neighborhoods with growth potential.

-

Work with Professionals: Partner with a real estate agent experienced in foreclosures and consult a property inspector before committing.

-

Secure Financing Early: If the property isn’t cash-only, get pre-approved for a loan to streamline the process.

-

Understand the Risks: Perform due diligence, including title searches, to uncover hidden costs or legal issues.

Is Buying a Foreclosure Worth It?

Is Buying a Foreclosure Worth It?

The answer depends on your goals, risk tolerance, and preparedness. Foreclosures offer excellent opportunities for those willing to navigate their complexities, but they’re not without challenges. For first-time buyers or those unfamiliar with the market, it may be better to stick with traditional home purchases or consult experts before diving in.

Final Thoughts

Buying a foreclosure can be a rewarding venture if approached with caution, research, and the right mindset. Whether you’re an investor seeking high returns or a homebuyer looking for a bargain, foreclosures can offer significant benefits when done right. With proper planning and professional guidance, the potential rewards can far outweigh the risks.

Contact Us to Get Started

Let's build your wealth in foreclosures together

2024 Copper Estates. All rights reserved.